How Startup Founders Can Use SPV Services to Build Strategic Investor Communities

Funding a startup is not merely a matter of writing checks anymore. For most founders, the aim has become to assemble a set of investors

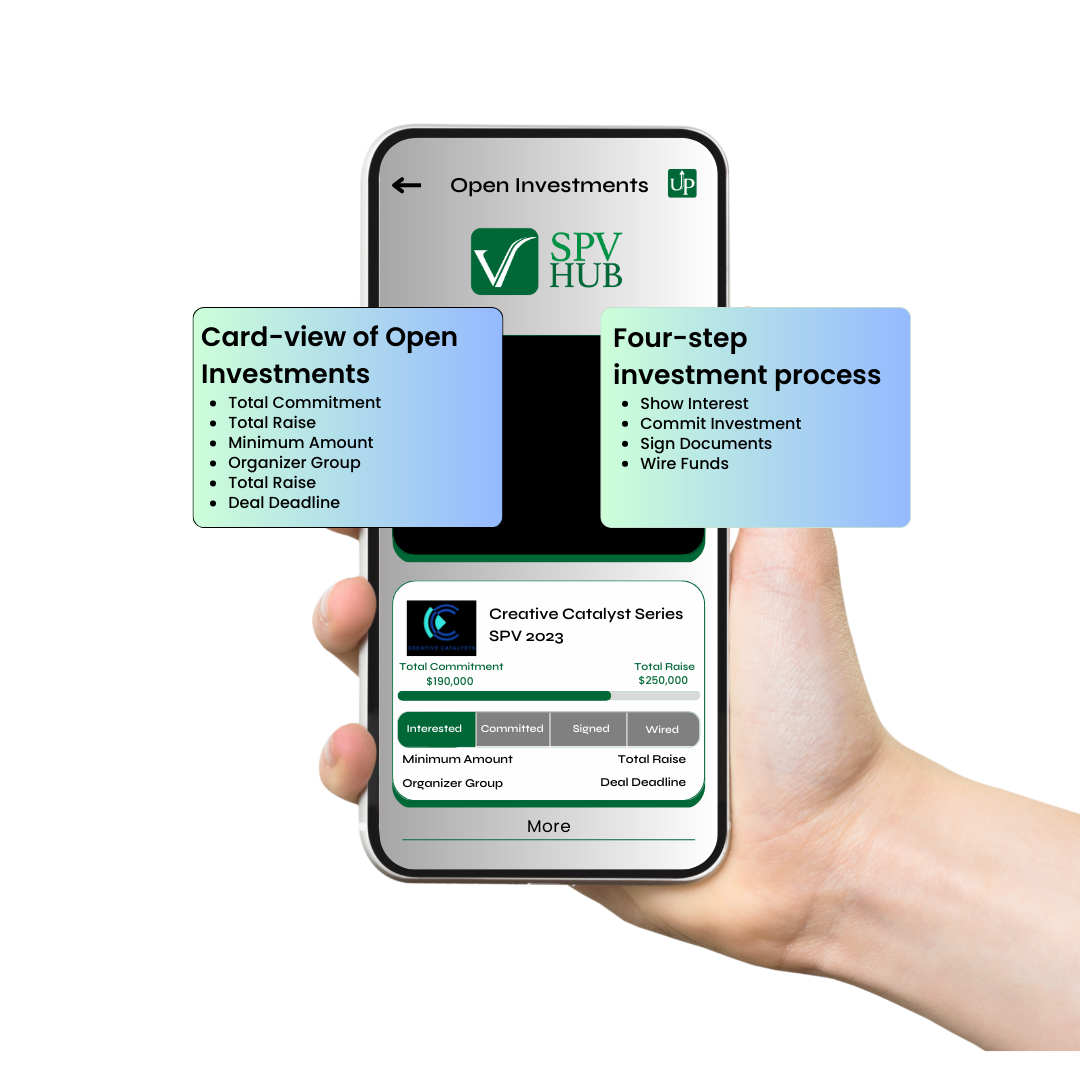

Bringing deal syndication on Smartphones to compliantly co-invest in SPVs, invite interested investors, manage Startup investment portfolio, and complete investment in just four-steps

Set up a deal

Share the deal and invite investors onboard

Streamline transactions with e-signature and multiple Amount Transfer Mode

Track the fundraising and your investment portfolio

Startup Steroid and SPV Hub are integrated and one can jump between the two platforms with just click of a button. Screen the opportunities, rate Startups, conduct due diligence and create SPV to set up a co-investment deal.

Easily onboard investors and share investment opportunities with our seamless investor onboarding process. Digital validation and secure data management, ensuring a smooth and efficient experience. Stay updated with real-time process status and assist investors with a portfolio dashboard for better insights and support.

Say goodbye to the hassle of collecting signatures and funds manually. With SPV Hub, we've got you covered with our user-friendly platform that automates the e-signature process and offers multiple convenient options to investors onboard for transferring funds and completing the co-investing process. It's all about making your life easier and ensuring a seamless transaction experience.

Step into the future of startup investments with SPV Hub, where we lead the charge in revolutionizing the startup landscape with a dynamic and game-changing approach. Our core focus revolves around the strategic utilization of special purpose vehicles (SPVs) to provide investors with unmatched advantages in their investment journey. Successful investment strategies demand a comprehensive approach, and that’s where our portfolio management solutions come into play.

On our platform, investors gain access to tools and resources that empower them to make informed decisions. We offer precise Portfolio Allocations tailored to each investor’s financial goals and risk tolerance, ensuring that their investments strategies align with their long-term vision. We also provide fund management Solutions to nurture and optimize investments for sustainable growth.

CSU Long Beach

Keiretsu Forum

Angel Capital Association

SPV Hub is an online fund management platform simplifying raising and deploying capital in a Startup through Syndicates. As the name suggests, our main activity is creating and administrating SPVs or Special Purpose Vehicles. Moreover, by opting for our back-end Administration, Legal, Accounting, Taxation, and Compliance solutions, you can stay in the good books of the IRS and dedicate your crucial time to deal-making. Our core expertise empowers Fund Managers and Investors to do what they do best – discover the best deals and build meaningful relationships while leaving the complex task of SPV Administration to us.

SPV Hub offers creation and administrative services for Special Purpose Vehicles specifically used for Investment in a Startup. The most preferred SPV is Delaware Master Series LLC, as it comes up with considerable benefits such as – minimal requirements, flexible structure, tax benefits, asset protection and much more. Incorporating an SPV in Delaware doesn’t mean that you need to be physically present in Delaware State, or Investment can take place in Delaware only. By forming a Master Series LLC under Delaware Divisions of Corporations, the participating parties can enjoy the benefits that DLLCA (Delaware Limited Liability Company Act) offers.

SPV or Special Purpose Vehicles are legal entities (lacking physical existence) created with an intent to isolate financial risk and manage funds. SPVs, also known as Syndicates, have a particular purpose. In the case of Startup Investment, the special purpose is to accumulate funds from different investors and deploy the same in the chosen Startup. Based on the share of Investment, the SPV gets the equity allotment. Further, according to Cap Tables, the equity share is allocated to participating investors.

Delaware Series LLC is a unique business entity consisting of a Master LLC and more than one Series under the Master LLC. As per Delaware Limited Liability Company Act (DLLCA), formed in 1996, the LLC created under Delaware Divisions of Corporation doesn’t hold any predetermined structure and offers the benefits of limited liability and tax-friendly regimes to participating members. Think of Delaware Series LLC (also renowned as Master LLC) as an umbrella. Under this umbrella, an organizer can add as many divisions (known as Series). Further, every Series hold its own identity and can enter into contracts. Currently, there is no limit on the number of Series that can be added under Master LLC. However, as every Series has its own identity, the operations, managers, bank accounts, members, and even tax elections can vary.

SPV Hub is a customer-centric Special Purpose Vehicle Platform. What makes us stand out from our competitors is our particular focus on making the entire process of raising and deploying capital in a Startup effortless by appointing a dedicated account manager acting as a single point of communication for any query. Under our Simple, Secure, and Dependable Structure, we have leveraged AI technology and created a comprehensive dashboard to maintain contact and transparency. But we also believe that technology can’t replace the human touch. Therefore, we proudly proclaim that we provide the best client service by appointing a personal SPV expert to every account for the complete lifecycle of an SPV.

Our central thought behind the development of the SPV Hub platform is to simplify investment for both – Fund Managers and Investors. Seeking the simplicity and transparency of operations, our clients prefer our platform over other SPV Platforms.

At SPV Hub, you can expect –

Fund Managers of an SPV get access to internal dashboards which will authorize them to keep a tab on Investment status. A Fund Manager can track – the committed amount, check which investor has signed the deal, and wired the funds.

We understand that the world of startup investments is both thrilling and challenging, which is why we’ve designed a platform that harnesses the incredible power of special purpose vehicles (SPVs) to revolutionize your approach to investment strategies. At SPV Hub, we celebrate the uniqueness of each investor, empowering you to customize your investments to align perfectly with your preferences and objectives. By pooling individual resources, we foster a collaborative environment where investors collectively gain access to a diverse array of startups.

Our comprehensive suite of investment strategies empowers you to effortlessly diversify your portfolio while offering the flexibility to fine-tune your financial goals. With our hassle-free fund management solutions, we equip you with the essential tools and resources to navigate the intricate world of startup investments. Join us today and discover how SPV Hub is not just changing the game but redefining collaborative investing, offering the expertise and support you need to elevate your investments to new heights.

Funding a startup is not merely a matter of writing checks anymore. For most founders, the aim has become to assemble a set of investors

Group investing has emerged as a favored alternative for those who want to fund startups or venture opportunities but do not want to do so

In today’s high-speed venture capital environment, deal structures can literally make or break the effectiveness of a fund. As more and more investors are looking

When you sign-up for Newsletter at SPV Hub, you will receive regular updates on profitable investment opportunity